Water Quality Trading: What Works? What Doesn’t? And Why Don’t We Know This Already?

Water utilities and NGOs around the world are using market-based mechanisms to clean regional waterbodies and restore surrounding watersheds, but critics say the programs are unproven. Proponents counter: yes, they are, and the data exists to prove it!

22 July 2016 | For years now, North American cities like Denver and New York have been diverting water fees into forest conservation, while Kenyan flower-growers have been voluntarily paying upland farmers to develop terraces that slow runoff. Just this week, legislators in the Peruvian Capital of Lima authorized a program that will divert some of the city’s water fees into the restoration of ancient, pre-Incan canals high in the Andes to capture floodwater for the dry season. In addition to these “investments in watershed services” (IWS) programs, water authorities in the United States, New Zealand, and Australia are experimenting with something called “water quality trading” (WQT), which aims to keep levels of fertilizer at scientifically acceptable levels by helping farmers implement conservation practices that reduce their agricultural runoff.

Each program is uniquely its own, but they all hinge on the premise that market-based mechanisms deliver better results and more flexibility by focusing on quantifiable, verifiable outcomes – either in terms of water quality or regularity of supply – rather than the rigid edicts of “command-and-control” regulation.

Last autumn, an organization called Food and Water Watch (FWW) challenged that assumption, at least as far as WQT is concerned, in a paper that re-labeled WQT as “pollution trading” and charged that it undermines the Clean Water Act (CWA) and puts US waterways at great risk – a contention that was promptly dismissed by WQT proponents like Brent Fewell and Bobby Cochran.

Fewell, a one-time senior official at the US Environmental Protection Agency (EPA) and founder of the law firm Earth and Water Group, penned a piece entitled “Food & Water Lies – FWW Stands in the Way of Environmental Protection” which derided the organization as being ideologically anti-market and anti-public private partnership, while Cochran, the Executive Director of the Oregon-based nonprofit Willamette Partnership, was a bit more forgiving.

“FWW did not do an independent assessment on water quality trading,” said Cochran, whose organization is active in the WQT space and often acts as an advocate for trading.

However, Cochran adds that proponents of trading aren’t producing objective content either.

And while the pro and con camps continue to argue, reams of hard data from dozens of pilot projects are sitting around just begging for a disinterested, scientific evaluation. Cochran, among other practitioners, suggest a third-party, independent review of this data to settle the debate over whether WQT is effective.

“Let’s have that independent evaluation,” Cochran says. “It’s an opportunity for both critics and supporters to take a clear-eyed look at what we’ve accomplished and what we’ve yet to do.”

It’s a call that seems to be resonating across the environmental community.

The Rationale

The massive quantities of nitrogen and phosphorous flowing into waterways is known as nutrient pollution, and the EPA identifies 15,000 water bodies struggling with nutrient-related impairments.

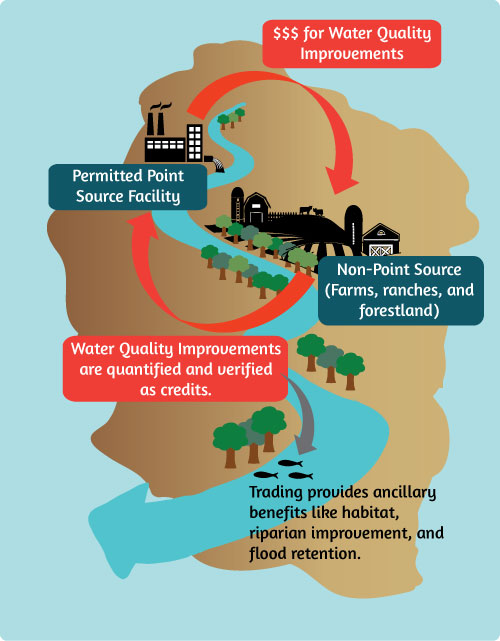

WQT is meant to be a cost-effective solution to this challenge, because it draws funding from industrial and urban dischargers to pay for reductions in the countryside. Advocates say it can address hard-to-reach areas and unregulated activities like small-scale agriculture, which is exempt from regulatory oversight even though runoff from farmland is a big factor when it comes to nutrients flowing into lakes and rivers. WQT holds potential to involve farmers and implement best management practices on farmland.

In a rebuttal to the FWW, the National Water Quality Trading Alliance (NWQTA) notes that WQT can broaden the field of stakeholders investing in water quality and produce additional environmental benefits such as wildlife habitat, land conservation, human health benefits and carbon reductions. The American Bar Association Journal is expected to publish the paper this summer.

“What we find out in practice is that markets can help to advance restoration,” says Brooks Smith, an environmental and natural resources Partner at the law firm, Troutman Sanders, and founder of the NWQTA.

The Unmined Data

Organizations like the Electric Power Research Institute (EPRI) aim to help hundreds of small farms reduce their runoff through its Ohio River Basin Trading Project, which generates a revenue for farmers from the sale of “stewardship credits” that companies buy to meet sustainability goals. Project lead Jessica Fox told Ecosystem Marketplace in January that the project team has worked with hydrologists and regulators across the Midwest to measure the impact that certain practices have in the water. They estimate the program has reduced discharges by more than 100,000 pounds.

“As far as determining if trading is going to have environmental outcomes that are useful and increase efficiency and lower cost, I think there is enough experience right now to have that assessment,” she says.

Smith agrees.

“As we’ve seen this experiment play out across the country, we now have a good amount of case studies to draw from,” he says, adding that roughly 20 individual projects are underway across roughly a dozen US states.

How to Measure Success?

The upcoming report, the State of Watershed Investments 2016, identifies several programs – from the Long Island Sound to New Zealand’s Lake Taupo – that are winding down ahead of schedule, having reached their water quality targets years early. The Long Island Sound program saved sewage treatment plants an estimated $300-400 million dollars in upgrade costs by letting facilities trade while they gradually made upgrades.

Success, however, isn’t just measured in economic efficiency.

“There are more ways to measure success than just water quality indicators and the financial data,” says Genevieve Bennett, lead author of the Ecosystem Marketplace report.

Fox, for example, points out that EPRI is a nonprofit with a public benefit mission statement, so the financial transactions aren’t necessarily the most important part – but how do you measure the impact of awareness raising, scientific influence, and co-benefits such as carbon storage or habitat for pollinators? She argues that these elements of trading programs are significant and should be accounted for.

Another Set of Eyes

The big question is: who will conduct the analysis?

“It seems like the best organization would be one that is independent of any particular project so that there is some arm’s length objectivity to it,” says Smith.

There is evidence that handing the task over to a completely neutral party can lead to progress, or at least change. In 2001, for instance, US lawmakers commissioned the National Academy of Science’s National Research Council to study wetland mitigation banking, determining its benefits, strengths and weaknesses. The council found mitigation banking standards are more ecologically beneficial than other forms of mitigation, such as mitigation implemented on the development site. The study, Compensating for Wetland Losses Under the Clean Water Act, recommended that all forms of compensatory wetland mitigation be held to banking standards. These findings influenced the 2008 Compensatory Wetland Mitigation Rule, which established “equivalent standards” and a preference hierarchy with banking holding the top spot.

Whose Job is This?

Brad Klein, a Senior Attorney at the Environmental Law and Policy Center, says regulators should conduct the analysis.

“It would be helpful to have other organizations provide an independent review of different programs as a way to help foster more consistency and shed a spotlight on them,” he says. “But at the end of the day, the obligation under the law falls on the regulators to do it.”

Cochran, however, says that regulating agencies are just going to determine if the project adheres to CWA standards and state rules.

“A state or federal agency is just going to put a check in the box or not. They’re not going to tell you if the program is performing socially, environmentally and economically,” he said.

Emerging Guidance

At a convening of the National Network on Water Quality Trading (NNWQT) in May, partners set out to establish principles that can guide individual projects in evaluating themselves. These guidelines are rooted in existing guidelines that the NWQTA established that address social, economic and environmental targets of trading projects. Essentially, the Alliance emphasizes setting feasible targets, measuring outcomes and sharing information appropriately.

Cochran says the National Network will work on establishing these evaluation principles over the next several months.

The Mississippi River Collaborative, a consortium of environmental organizations and legal centers from the Mississippi River region, has also produced guidance WQT project developers can follow. It establishes five principles that focus on transparency, public participation and accountability among other elements. The first principle notes compliance with the CWA, an absolute must, adding also that trading cannot lead to “hot spots”.

A Self-Appraisal

Meanwhile, EPRI’s Ohio River Basin Trading Project is in the midst of a self-evaluation, encouraging stakeholders to fill out a brief survey, which asks them, among other questions, their opinion on the key elements of a program. Key elements could include finance funneled to communities or perhaps ancillary ecosystem services benefits.

The Ohio Basin project developers also created a scorecard, which will incorporate transparency and disclosure elements most seen in corporate sustainability scorecards.

Fox says the scorecard will likely be the size of an actual scorecard and include metrics the project developers favor for measuring success but also include those stakeholders deem important.

A Piece of the Puzzle

The NWQTA make it clear that WQT is not appropriate everywhere, and Cochran and Klein acknowledge that FWW’s concerns about transparency, deliverables and accountability are often valid.

Fox notes even more complex and intricate challenges that plague trading such as poor policy and regulatory drivers and state numeric nutrient criteria that fail to mobilize WQT.

“Trading isn’t a silver bullet. It’s not a panacea,” Klein says. “But we need to get on top of this issue of water pollution and water quality trading may be another arrow in the quiver.”

Kelli Barrett is a freelance writer and Editorial Assistant at Ecosystem Marketplace. She can be reached at [email protected].

Please see our Reprint Guidelines for details on republishing our articles.