Today’s VCM, Explained in Three Figures

Is the market truly booming? Are offsets the next big solution or a scam? And what’s up with carbon crypto tokens? Here’s a quick tour through the voluntary carbon market, courtesy of our Ecosystem Marketplace analysts.

If you want to learn more, visit our public Data Intelligence & Analytics Dashboard, and download the latest State of the Voluntary Carbon Markets report, where all of these insights were first published.

One: Voluntary carbon credit transactions quadrupled in value last year, but in the big picture, they’re still a drop in the bucket.

Voluntary Carbon Market Value, pre-2005 to 2021.

Voluntary markets leapt from $520 million in 2020 to $2 billion in transactions in 2021. That jump was driven in large part by rising prices for credits, especially for nature-based credits for activities like reforestation, “blue” carbon from coastal and marine ecosystem projects, and avoided forest conversion. Buyers like these credits in part because they deliver non-carbon benefits such as income for communities, or protecting biodiversity. We’ll come back to that point later.

This boom is a sign that net zero carbon pledges are moving the needle, and companies and other actors are using offsets to trim emissions that are otherwise hard to cut right away.

It also means $2 billion in additional finance for green projects around the world. Overall, the voluntary carbon markets have delivered $8 billion in climate finance since we began tracking them in 2005. That’s a significant contribution to the climate effort, but when you compare it to, say, fossil fuel subsidies, which total $6 trillion a year, it’s a pretty small number.

Likewise, when you measure humankind’s total global emissions every year, voluntary carbon market activity at 500 million tons equates to only about five days’ worth of emissions. Carbon offsets, in other words, are a useful tool, but neither a silver bullet nor a global menace.

Two: Carbon credits are more like sandwiches than soybeans.

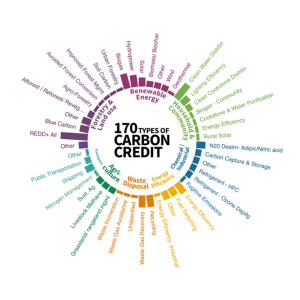

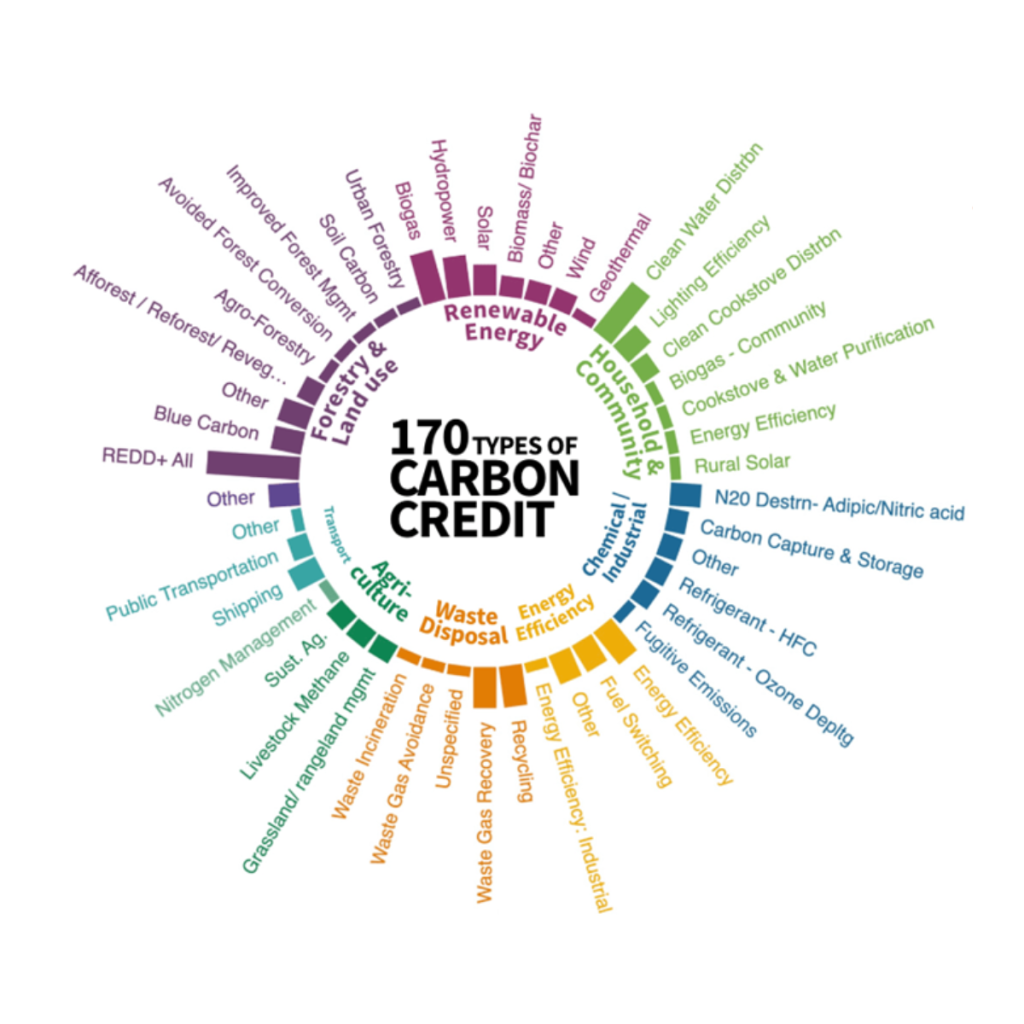

What’s in a Category? Ecosystem Marketplace’s Carbon Offset Project Typology, 2021.

In other words, they’re much more a heterogeneous product (with attributes that vary significantly from one another, and consumer segments with different quality preferences) than a homogeneous commodity. That might not be immediately obvious – isn’t a ton of carbon always a ton of carbon when it comes to mitigating climate change?

Yes. And yet one of the side effects of a renewed focus on carbon markets integrity has been a sharpening of preferences on attributes that differentiate one ton of CO2e from another: does the project deliver co-benefits for communities or biodiversity, for example? Is it a carbon reduction or removal? Is the credit nature-based or technological?

Suppliers have responded with lots of choices. We tracked 170 different credit types transacted last year. The figure above shows them grouped into eight general categories.

We’re seeing a very clear price premium above that price for credits with additional non-carbon social and environmental benefits. Projects in the Forestry and Land Use category command the largest share of trades (46%) and the highest prices with a weighted average price in 2021 of $5.80 per ton. (Our 2021 global benchmark price across the whole market is $4.00 a ton.)

Renewable energy comes in second in terms of trading volumes (43% of trades) but at far lower per-credit prices: $2.26/ton on average in 2021, probably reflecting a consumer segment that is mainly buying based on price – a very different group from the Forestry and Land Use buyers.

Ecosystem Marketplace has made a number of upgrades to its data infrastructure and user services in response to this diversity, to provide richer, more detailed, and even more highly vetted data. A high-integrity market requires not just transparency but granularity. As we’ve seen, there’s more to a credit than a ton of carbon.

Three: Direct relationships and a good project story are still preferred over more standardized exchanges and crypto.

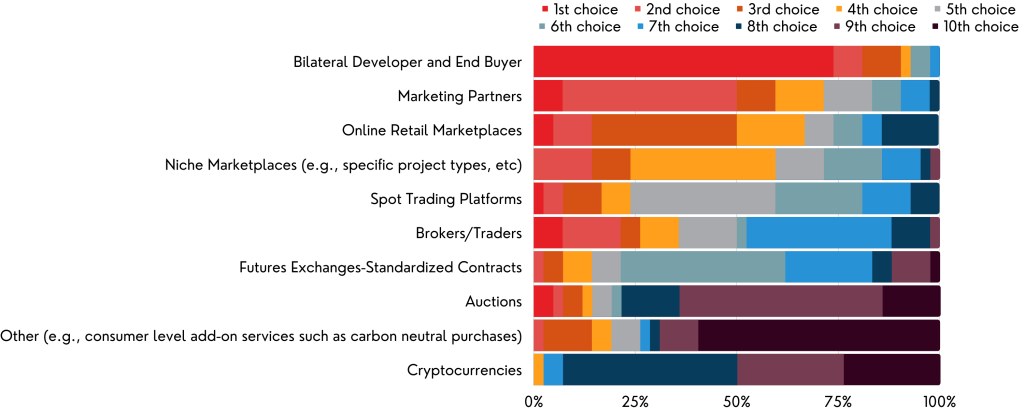

Buyers’ and Sellers’ Preferred Voluntary Carbon Market Transaction Methods, 2021.

We’re seeing lots of new entrants offering new ways to trade carbon credits. We asked our Global Carbon Survey respondents how they prefer to buy and sell.The vast majority still prefer bilateral deals between project developers and end buyers. These are advantageous for project developers, who can respond directly to corporate requests for proposals and build a relationship. Project developers also get to shine in retail marketplaces and niche marketplaces (the third and fourth most popular transaction options) that allow for storytelling and rich information about projects. And buyers get to develop a more direct relationship with the project proponents, who may be half a world away.

Intermediaries such as futures exchanges are popping up these days, but have yet to gain as much traction. By working with digital spot trading exchanges they can also offer standardized futures contracts pegged to specific project attributes or compliance requirements. As futures contracts become more common (so buyers can secure future supply of credits), these exchanges could get more popular.

Crypto has had a lot of recent media coverage, but was identified as respondents’ least preferred transaction method. Blockchain, as a disruptive technology, could represent a new area of innovation and growth, or, if abused, a throwback to the old “carbon cowboys” days of the voluntary markets. Several leading market institutions are developing guardrails to make sure that tokens marketed as delivering the benefits of carbon credits are in compliance with the standards bodies issuing the initial credits.

Please see our Reprint Guidelines for details on republishing our articles.