New Investment Model Uses Water Markets And Impact Investors To Restore Nature

When the myriad players in a single watershed start jockeying for water rights, nature is often left out resulting in degraded ecosystems and species decline. But The Nature Conservancy says innovative impact investing in water markets can shift water back to the environment while still delivering benefits to farms and people.

24 August 2016 | Impact investors searching for new investment opportunities that can deliver a triple bottom line may be interested in a model The Nature Conservancy (TNC) recently developed. Called Water Sharing Investment Partnerships (WSIP), they are meant to ease water scarcity in stressed regions while also conserving and restoring watery ecosystems.

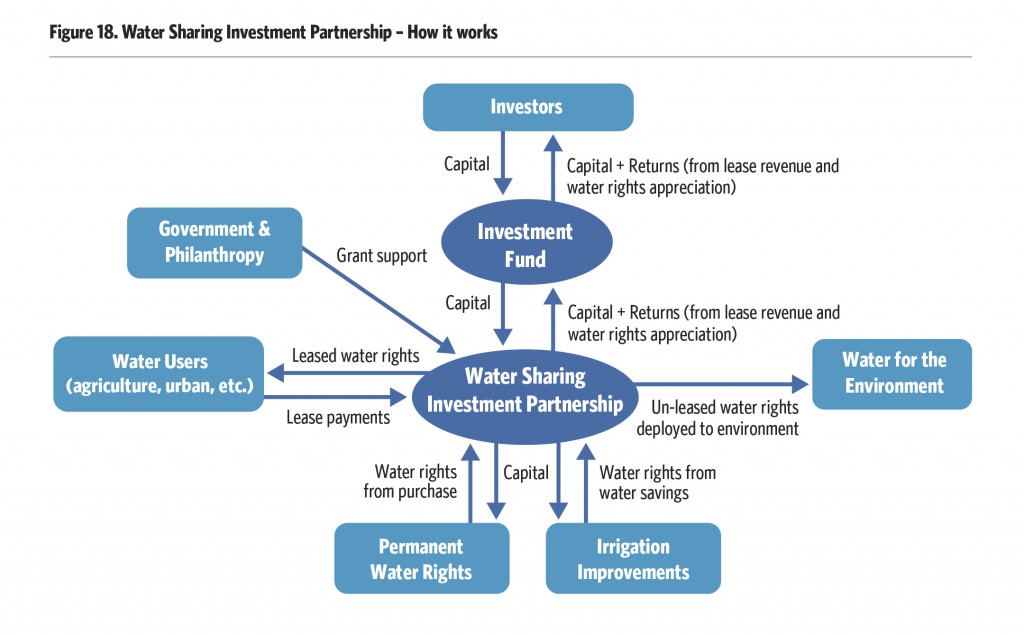

WSIPs leverage existing water markets for conservation purposes, TNC explains in a new report called, Water Share: Using Water Markets and Impact Investing to Drive Sustainability, which the NGO published this week. Essentially, they solicit investor capital to acquire a portfolio of water rights. Most of these rights are either leased or sold back on the market, giving investors a financial return and ensuring farmers and cities have access to enough water. A WSIP can acquire water rights by outright purchases, but also by collaborating with farmers to implement water saving measures in irrigation.

Both of these methods free up water rights allocations to be used to divert water back to nature, restoring water flows in a manner that sustains healthy ecosystems.

“The WSIP model is one of several tools the Conservancy is developing to improve water security among all water users,” Lauren Ferstandig, Director of Product Development for TNC’s NatureVest, said in a statement. “The hope is that these partnerships can help provide a more water-secure future for cities, agriculture, industries and nature.” NatureVest is TNC’s impact investment unit.

The constant tug-of-war between different entities such as farming and cities enables global water shortages to rage on. Just a glance at the World Resources Institute’s Aqueduct Water Risk Atlas reminds viewers of the severity and wide range of water-related risks across the globe. The United Nations predicts 1.8 billion people will be living in countries or regions with absolute water scarcity by 2025.

Moreover, according to WWF’s most recent Living Planet report, freshwater species populations have declined 75% between 1970 and 2010. This statistic highlights one of the report’s messages, which is that nature is the silent and often unseen victim of water scarcity. Water depletion is a leading cause for decline.

“We need to get smarter about how we use every drop of water,” Brian Richter, lead report author and Chief Scientist for the Water program at The Nature Conservancy, said in a statement. “We can no longer build our way out of water scarcity. The closer water consumption grows toward the limits of water availability, the more we put ourselves at risk. But new approaches in water management can shift us toward long-term sustainability.”

What’s so Good about Water Markets?

Some practitioners in the water space say water markets can drive the needed water-efficiency practices that will ultimately lead to sustainability. When water carries a monetary value, those who have the rights to water supplies are motivated to conserve because they can sell the surplus for a profit, the Conservancy explains.

The report highlights six noteworthy benefits of water markets:

- Stimulating water savings – By establishing a monetary value for water, water markets can provide strong stimulus for reducing consumptive water use because a water-saving entity can be rewarded financially by selling or leasing the portion of their water rights that is no longer needed. When water is appropriately priced it also discourages waste.

- Increasing water availability – By accessing additional water through a market, a community or government can avoid expensive, time-consuming and environmentally-damaging alternatives for increasing their water supplies.

- Improving community flexibility – By enabling the transfer of water between users, individuals and communities can adapt more quickly to changing conditions, personal preferences and needs. This includes providing farmers with new, revenue-generating opportunities and options for averting irrigation shortages during droughts.

- Improving water’s productivity and allocation efficiency – By discouraging wasteful or low-value uses of water, the trading of water facilitates reallocation of water rights to more productive uses, commonly resulting in more revenue generation in local economies.

- Returning water to nature – Markets offer opportunities for conservation interests and government agencies to restore water flows in depleted freshwater and estuarine ecosystems by purchasing water in the market and then dedicating its use to environmental purposes.

- Improving accounting for water use and availability – When water is appropriately priced and water assets are being traded, water users are more willing to participate in transparent water measurement and reporting practices.

Leveraging Powers

WSIPs leverage the incentives for water trading, Richter explained. WSIPs also leverage the growing realm of investors interested in having a positive impact on the environment and society along with securing a financial return.

“We do know there’s a huge amount of interest, particularly from wealthy millennials, to have a more socially and environmentally conscious portfolio,” Ferstandig said.

However, WSIPs will use philanthropic and grant finance as well as private capital, the report says.

Also, WSIPs will only function in countries with existing water markets. Report authors count 37 water scarce nations with water allocation systems based on distributing water rights, which with the right policy drivers, could harness the powers of impact investing for conservation and water efficiency.

TNC launched the first WSIP in Australia, home to perhaps the world’s most famous water market system. Essentially, this WSIP consists of two parts, the Murray-Darling Balanced Water Fund and the Environmental Water Trust. Investments from wealthy well-known Australian families, corporates and other entities helped put USD $20 million into the Murray-Darling Balanced Water Fund. Much of that is funneled back into the agricultural community, though a portion of the water rights allocations is donated to the Environmental Water Trust to be used to restore some of the basin’s water-starved wetlands. The trust targets wetlands with high ecological and indigenous value, the report says.

Within the next four years, the Murray-Darling Basin Balanced Water Fund aims to scale up funding to USD $76 million.

The Right Fit

Of course, one size does not fit all and the report authors emphasize tailoring any market-based strategy to the water conditions of that particular water-scarce basin. They also note WSIPs is just one variation of the innovative, investor-funded finance regions can use to overcome their water scarcity.

TNC lists four major investor-funded market-based solutions to water scarcity.

- Long-term water trades within farming communities by establishing ‘farmers’ water markets’ – suited for basins with chronic scarcity and most water use going to irrigated agriculture

- Long-term trades between farmers and cities – designed for basins experiencing chronic water scarcity with mixed uses of water

- Short-term trades within farming communities – where farmers temporarily reduce water use on low value or annual crops and trade the saved water

- Short-term exchanges between farmers and cities – freeing up agricultural water during drought years may be more effective than urban conservation strategies.

According to Ferstandig, if countries with existing water markets implemented all four of these systems, they could generate annual sales of over USD $ 13.4 billion.

However, significant political will and action is required to pull this off.

Ferstandig said in a press release: “Bold leadership and action will be required to truly unleash the benefits and potential of water markets around the globe.”

Please see our Reprint Guidelines for details on republishing our articles.

There are a few new water investment schemes being established in Australia. Readers of this article might be interested in directly investing in water. You don’t need to own land to own water in the Southern Murray-Darlin Basin. It’s easy to do by contacting a broker such as myself here: https://www.wbw.net.au/

The alternative is to go through an investment scheme. These schemes benefit from diversity and lower temporary trading costs, so they suit the smaller investor. Large investors should look to buying directly and you can save on management costs.