A Financial Architecture for Global Carbon Sinks: A New Forestry Investment Strategy

Natural climate solutions can get us one-third of the way to meeting the Paris Agreement’s 2-degree target, but they draw just 3 percent of climate finance. We can change that by developing a new financial architecture that recognizes nature as an asset class, and New Forests’ CEO David Brand says forestry’s evolution as an asset class can inform that development.

This post has been adapted from a New Forests brief, “Transforming the Forestry Asset Class.”

15 July 2019 | Imagine an asset class that has low correlation with other major asset classes; positive correlation with inflation; and generally good returns relative to risk and volatility. Imagine that the underlying assets are perpetual in nature, with continuing cash yield once properly managed. What if I suggested that same asset class can provide an important contribution to addressing global challenges like climate change, biodiversity conservation, ensuring fresh water supply, and rural economic development? It might sound too good to be true, but that asset class is forestry.

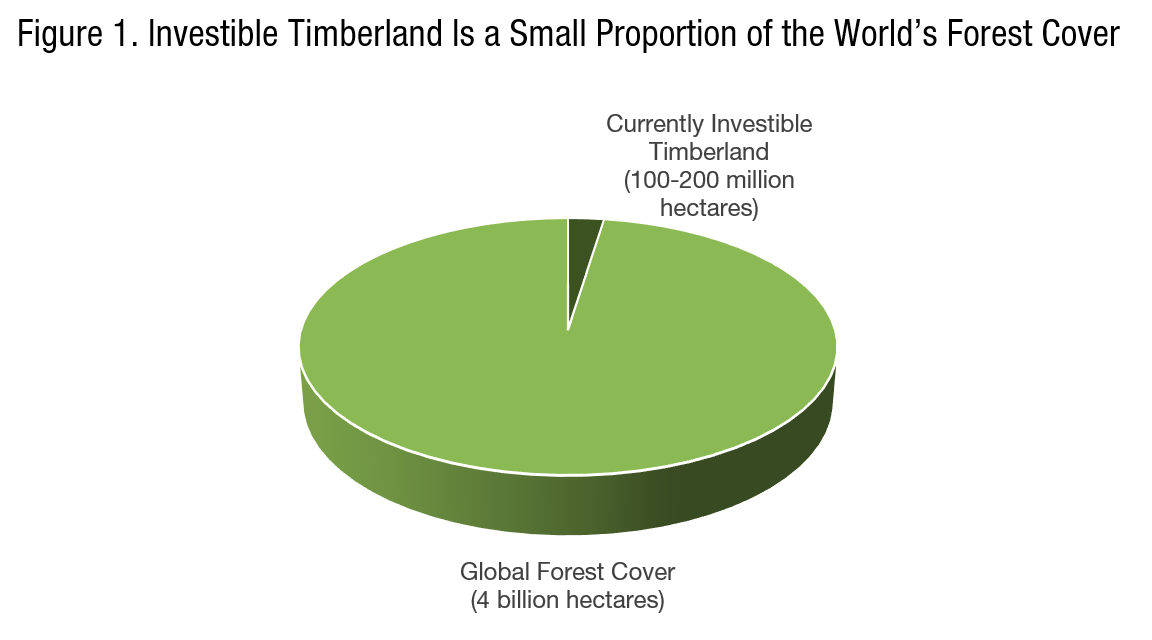

Forests cover 31% of the world’s land surface, about 4 billion hectares. Most of the world’s forest, is remote, extensive government-controlled lands, and is not considered “investible” under current market conditions. Several hundred million hectares more have extensive, but active, forest management under government control in areas like Canada, the United States, Russia, Southeast Asia, Africa, and Latin America. The remainder is around 100 to 200 million hectares of intensively managed forest, which forms today’s “timberland” asset class (Figure 1).

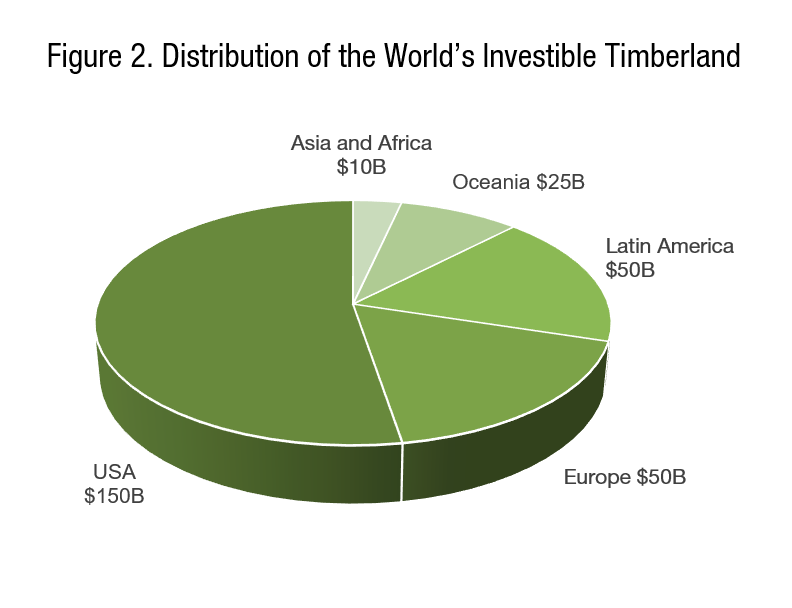

Most of these assets are forests managed primarily for wood production, often as timber plantations. If you look around the world at where these forests are located, there are about 30-40 million hectares in the United States, mostly in the US South and Pacific Northwest; there are 7-8 million hectares in Brazil, and another 3-4 million hectares in Uruguay, Argentina, and Chile; about 4 million hectares in Australia and New Zealand (included in Oceania as a region); 3 or 4 million hectares in Southeast Asia; 2 million hectares in Africa; and 4 or 5 million hectares in Europe. There are also intensively managed natural or semi-natural forests that could be considered part of the forestry investment universe both on privately owned land and government leases. This would include parts of Scandinavia, Canada, Southeast Asia, and Africa, for example.

When you look at the total value of this “investible universe” of timberland, it is relatively small as a pool of assets, probably in the order of USD 200-400 billion depending on how you define “investible.” Figure 2 provides an estimate of the current investible universe, considering what is already investor-owned and what assets might be made available to investors in the near term. Of the total investible universe, around USD 100 billion is already owned by timber real estate investment trusts (REITs) and institutional investors, whether via investment managers or directly.

The forestry asset class began in the United States. Owing to Generally Accepted Accounting Principles (GAAP) rules and the tax-free status of pension funds, it became clear that having forestry assets owned by the forest industry was inefficient, and a steady process emerged from the mid-1990s until about 2008 with the US forest industry selling billions of dollars of forestry assets to institutional investors. As a track record emerged of the investment performance of these assets, a consensus arose that this was a financially interesting asset class, and investor demand increased. As the asset class grew, discount rates declined as demand outstripped supply and investors determined that rising liquidity and predictability of returns reduced the risk premium needed. For example, basic timberland discount rates for US Southern pine plantations dropped from about 800 bp over the risk-free rate in 2000 to about 500 bp over the risk-free rate by 2007.

Alongside this was the early stages of an internationalisation of the asset class. Initial institutional forestry investments in Latin America, New Zealand, and Australia began in the 1990s. Over the past 15 years, this has accelerated—in Australia and New Zealand more than half the forestry plantation estates are now in institutional ownership and that trend is still evolving. Latin America has been somewhat more challenging for international investors to navigate for various reasons, including restrictions on foreign landholding in some countries, competition from local firms often backed by government loans, bureaucratic regulations, and volatile currencies. Other emerging markets like Asia or Africa have attracted some investor interest, but for many investors the risks associated with emerging markets have run counter to the desire for forestry assets with low volatility and stable, predictable returns.

As noted above, there is around USD 100 billion of institutional and REIT-owned forestry assets today, of which approximately 70% is in the United States, 20% is in Australia and New Zealand, and 10% is in the rest of the world. Putting aside the REITs, about 60% of institutional investment is via funds, and more than half of the capital is from public pension funds.

The large-scale rationalisation of first the US and then the Australia-New Zealand forestry sectors has largely run its course and asset turnover is slowing. The wave of capital seeking real assets over the past 20 years has meant that forestry has been a sellers’ market, much like core real estate and infrastructure. Some investors are becoming frustrated and saying that the forestry asset class is overbought.

All this brings us to the central question for investment strategy: where to from here?

We see two key trends with exciting potential to disrupt the forestry asset class and directly support climate action: first, new opportunities in the forest sector from sustainability, and secondly, a rising role for investment. The next section will discuss each of these trends in greater detail.

Sustainability Performance and Management

The concept of sustainability is not new in the forestry sector. There is a well-established set of forest sustainability performance considerations, such as forest management standards, certification schemes, environmental, social, and corporate governance (ESG) metrics, and sustainability reporting.

However, what is changing is the recognition that sustainability is not a cost, but an opportunity for forests to be a central part of solutions to major challenges like climate change, biodiversity conservation, freshwater regulation, and community development and land rights. This opportunity requires a transformation from the forestry sector of the past as well as a new way of thinking about the value of forests.

Forestry was seen in the past as destructive and unsustainable, and forests were often viewed as an impediment to land development for agriculture. Natural forest harvesting often ignored or made modest accommodation to environmental or social values.

The underlying issue was unpriced externalities. Forests contain 1.6 trillion tonnes of carbon dioxide equivalent, which is more than the carbon dioxide in the atmosphere. Forests support about 50% of the diversity of life on earth. Almost all freshwater cycles though forests, and forests regulate water flow and water quality for downstream users. These benefits are called ecosystem services, and they are provided to our human society for free by nature. In an economic context, they are unpriced positive externalities from maintaining, enhancing, or restoring forests. The problem with free goods is that they are used wastefully or destroyed, often alongside economic activities where the value of a market good or service is more attractive. For this reason, we see deforestation associated with commodities like soy, cattle, and palm oil. This has been a central threat to forests and has led to substantial deforestation driven by agriculture and has made forestry a less commercially valuable land use than market crops.

Fortunately, this trend is changing. Forest conservation, reforestation, and forest plantations are now seen as a central part of action on climate change. The California carbon market, operating since 2012, has shown that forests can be valued for their carbon storage as well as their timber value, and there are also emerging and expanding policies related to using green infrastructure for watershed management as opposed to grey infrastructure based on concrete, pipes and treatment plants. In some ways we are in a race to create price signals for the positive externalities of forests so that they become a kind of natural infrastructure asset class providing both renewable, environmentally sustainable goods and ecosystem services on a perpetual basis.

The Rising Role for Investment

To realise these opportunities we require a corresponding development: a rising role for investment. The global forestry sector needs to be transformed and recapitalised by long-term, patient capital. The old paradigm of a “timberland” asset class is going to be replaced by new investment models that encompass both conservation and production as commercial businesses; embrace community forestry and shared rights to land with community groups or indigenous peoples; may be increasingly focused on emerging markets, rather than the traditional forestry regions of the US and Europe; and may integrate development, philanthropic, and commercial capital together.

That is not just a tinkering with the existing timberland asset class, it is disrupting it and re-inventing it. But what does that do for the portfolio characteristics of forestry investment? First, the underlying nature of forestry assets remains based on biological characteristics that generate the low correlation with other asset classes, and timber value will remain an important part of the return characteristics of the asset class. Second, the low volatility of timber comes from the optionality of trees—they can be grown for capital appreciation or cut for income. In poor market conditions, the forest still generates capital appreciation even if there is a decision to reduce harvest rates. Exposure to markets for carbon offsets, watershed conservation, biodiversity conservation, etc. creates even more optionality and ability to optimise returns over decadal periods of time. Lastly, the perpetual nature of the asset class is preserved and even enhanced in such a new structure.

This transformed forestry asset class may also include a changing risk profile. There may be greater exposure to emerging market risks, for example, but when we think about portfolio construction, the bulk of forestry assets for the next 20 or 30 years will remain in developed markets with a geographic shift slowly but steadily over time. In a successful global economy, emerging markets will also steadily decline in risk and improve in their business characteristics. It may even be that new forms of blended finance structures mitigate the emerging market risk and provide investors capacity to segregate financial and sustainability related outcomes. All this is already emerging.

The Evolving Forestry Asset Class

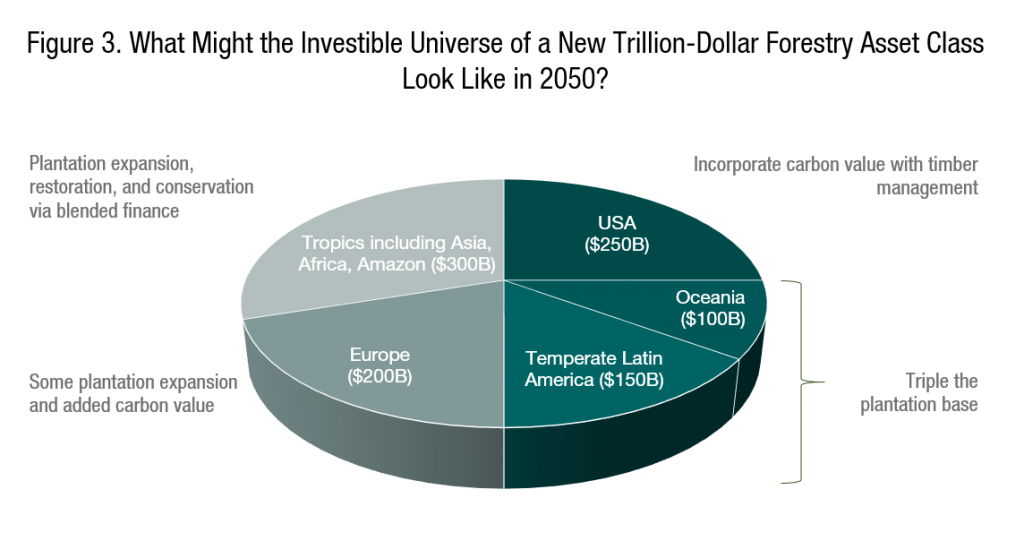

These drivers can fuel and sustain the evolution of the forestry asset class. How would this change the investible universe of forestry? What types of forestry and forestry investment would we see? New Forests suggests that by 2050 we could see a trillion-dollar forestry asset class, comprised of forests with combined production and conservation value (Figure 3).

These are innovations within an existing asset class but are also reflecting a shift of the asset class to take advantage of new opportunities and market changes. This will continue, and the rate of innovation will increase. As we head towards a world with 10 billion people earning an average of $30,000 per capita, that means one planet with a $300 trillion gross world product. Sustainability will be central to everything, and renewable materials from sustainably managed natural infrastructure will need to become a key asset class.

This post has been adapted from a brief produced by New Forests Asset Management Pty Ltd (New Forests) and may not be reproduced or used in any form or medium without express written permission. The original document is dated 20 March 2019. Statements are made only as of the date of this document unless otherwise stated. New Forests is not responsible for providing updated information to any person. The information contained in this document is of a general nature and is intended for discussion purposes only. The information set forth herein is based on information obtained from sources that New Forests believes to be reliable, but New Forests makes no representations as to, and accepts no responsibility or liability for, the accuracy, reliability or completeness of the information. Except insofar as liability under any statute cannot be excluded, New Forests, its associates, related bodies corporate, and all their respective directors, employees and consultants, do not accept any liability for any loss or damage (whether direct, indirect, consequential or otherwise) arising from the use of this information. New Forests Advisory Pty Limited (ACN 114 545 274) is registered with the Australian Securities and Investments Commission and is the holder of AFSL No 301556. New Forests Asset Management Pty Limited (ACN 114 545 283) is registered with the Australian Securities and Investments Commission and is an Authorised Representative of New Forests Advisory Pty Limited (AFS Representative Number 376306). New Forests Inc. is registered as an Investment Advisor U.S. Investment Advisers Act of 1940, as amended. Registration with the SEC does not imply any specific or certain level of skill or training.

Please see our Reprint Guidelines for details on republishing our articles.