Shades of REDD+Carbon removals, the Paris climate goals and permanence requirements

This blog argues that while permanent removals are essential, Paris-aligned mitigation requires massive carbon removals now, which only nature can deliver.

Permanence is a key requirement of high integrity carbon market projects. Durability of carbon removals – in carbon markets described as “permanence”– refers to the timeframe that carbon sequestered from the atmosphere remains stored before it is being released again. This risk of release and, consequently, the time sensitivity of climate benefits, is particular to carbon dioxide removal (CDR) projects. Nature-based CDR projects that store carbon in trees or soil run the risk of that carbon being released if the trees are felled or the soil is ploughed. Technology-based CDR projects that store carbon in rocks and other geological formations also face a reversal risk, but once carbon is stored in chemically stable compounds, this risk is small. The risk of reversals of carbon removals makes durability essential when considering carbon removals in climate mitigation strategies.

Initiatives like the influential Science-based Targets initiative (SBTi) limit the use of carbon credits to neutralize greenhouse gas emissions to those that permanently remove carbon from the atmosphere. The EU Parliament also suggests to limit the use of offsets to “permanent removals as defined in the proposed Regulation of the European Parliament and of the Council establishing a Union certification framework for carbon removals” [1] or similar schemes recognized by the Commission. The EU Carbon Removals and Carbon Farming Certification Regulation (CRCF) defines “permanent” as covering at least several centuries, scientists suggest a threshold of 1,000+ years to qualify as permanent removals. Since only carbon stored in geological formations can be considered permanent according to that definition, the SBTi’s limitation to permanent carbon removals discourages investments in nature-based carbon.

Science demands rapid and massive emission reductions and carbon removals.

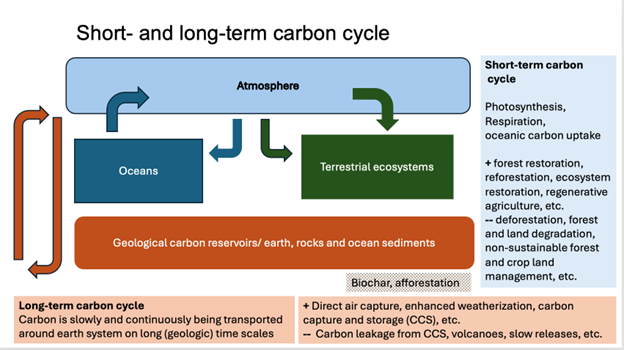

Carbon is the backbone of all life on Earth. Carbon atoms are in constant motion, traveling from living organism to the atmosphere and back into organisms. This quick turn-around of carbon defines the Earth’s short-term carbon cycle. There is also a long-term carbon cycle. Most of the Earth’s carbon is stored in rocks and sediments, from where it is only set free through occasional volcanic eruptions. Over millions of years, plant materials can also become oil, coal, or natural gas instead of sedimentary rock, which, if left undisturbed, store carbon underground for millennia.

Humans constantly disrupt both the short-term and the long-term carbon cycles. Deforestation accelerates the release of carbon in the short-term cycle. Burning fossil fuels very quickly releases into the atmosphere carbon that would otherwise leak very slowly, over millions of years. Burning fossil fuels moves carbon from the long-term, slow cycle to the short-term, fast cycle. Over time, it is essential that we restore both long-term and short-term carbon reservoirs, separately. Removing carbon through investments into nature-based removals is urgently needed. However, increased removals by natural carbon sinks cannot compensate for the loss of carbon stored in permanent compounds. Both forms of carbon storage are essential for life on Earth.

Science provides powerful arguments for investments into nature as well as into novel technologies that remove carbon from the air and store it in geological formations. To meet the temperature goals of the Paris Agreement, the Intergovernmental Panel on Climate Change (IPCC) estimated that global greenhouse gas emissions had to peak before 2025 and then rapidly decline.[2] Since it is now certain that emissions will peak later, even more rapid reductions are needed to still meet Paris temperature goal. This means that immediate and immense greenhouse gas reductions are required and should be prioritized across all sectors. But emission reductions will not be enough. In addition to emissions reductions, carbon dioxide removal is required to ensure a balancing of emissions and removals in the second half of the century.

Meeting the temperature goal of the Paris Agreement requires scaling investment into nature.

Meeting the temperature goals of the Paris Agreement requires fast and scalable carbon removals to drive short- and medium-term planetary cooling. Carbon stored in biomass plays an essential role in lowering the global temperature peak, reducing the risk of climatic tipping points, and slowing the rate of temperature increase. Well-designed natural climate solutions also come with important benefits such as protecting against irreversible biodiversity loss, stabilizing water cycles, and ensuring humans’ continued access to essential economic and cultural resources.

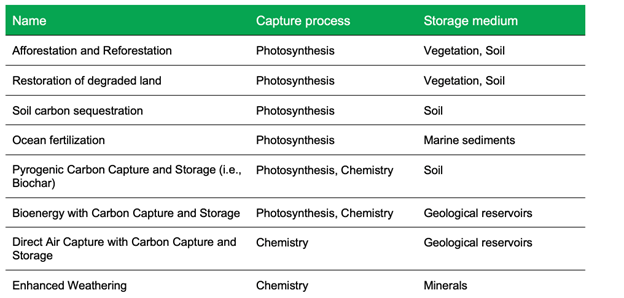

An important consideration is also the scalability and feasibility of different carbon removal strategies. So far, nature-based carbon removals are faster to implement and easier to scale than restoration of geologic carbon pools. Technology-based carbon removal strategies, such as direct carbon air capture or enhanced rock weatherization, are still in development and piloting phases. Even relatively well-understood technologies such as carbon capture and storage face legal and technological barriers to full deployment. While investments in all these technologies are essential, at the moment only nature is investment ready and – with appropriate social and environmental safeguards – scalable. Therefore, investments in short-term natural removals can balance emissions and stabilize temperature in the second half of this century, while investments into long-term storage will help to achieve net-negative greenhouse gas emissions in the long term.

Tailored policy incentives promote different type of carbon removals.

Different carbon removal methods must be evaluated in the light of different policy goals. Policies rarely have a horizon beyond a few decades, much less longer than a century. Similarly, carbon project developers’ responsibilities and liabilities typically do not extend for more than a few decades. No person or entity would be able to guarantee storage for centuries, and neither would any policy or standard ensure enforcement over such long periods – irrespective of whether carbon is stored in trees or old mines. It is therefore important that policies create incentives to store carbon in nature as long as possible using “sticky” policies that reduce the risk of reversals. At the same time, investments into long-term carbon sequestration must be ramped up.

The climate impact is greatest if different carbon removal strategies are combined. For example, the CRCF Regulation incentivizes short- and long-term carbon removals, considers the reversal risks of different methods, and formulates rules and liabilities depending on such risks. The CRCF distinguishes permanent carbon removals, carbon farming, carbon storage in vegetation and soils, and carbon storage in products, and provides different certificates for each. However, it is not clear how the EU will mobilize demand for the different removal certificates.

Nature is indispensable to meet the temperature goal of the Paris Agreement. However, nature cannot solve the long-tail effects of climate change—that requires carbon to be permanently removed for very long timeframes. The most durable climate solutions incentivize investments into nature first, which later can be replaced with chemically-stable technological carbon removals. Such replacements can happen at the project level. But it is easier and more efficient to ensure such replacement at the aggregate policy level. As in other policies, governments can sequence policy outcomes to complement each other. This may be more effective than imposing additional investment or permanence requirements that may discourage the already insufficient investments in nature.

Natural carbon removals should be supported by carbon market integrity initiatives.

To be Paris-aligned, carbon markets should encourage investments into natural and technological carbon removals. Initiatives like SBTi that are seeking to increase carbon market integrity should consider what is needed to meet the goals of the Paris Agreement – which is the current climate change policy priority. Permanence is an important quality criterion, but should not be used to exclude essential, immediate investments into nature-based removals. Investments into feasible removals right now are in many ways more urgent than ensuring carbon removals are in place in thousands of years. Carbon investment should also support novel carbon removal technologies, but additional investment incentives will be required to bring those technologies to the stage where they can be scaled. Nature is already there.

[1] European Parliament legislative resolution of 12 March 2024 on the proposal for a directive of the European Parliament and of the Council on substantiation and communication of explicit environmental claims (Green Claims Directive) (COM(2023)0166 – C9-0116/2023 – 2023/0085(COD))

[2] IPCC. Chapter 3: Mitigation Pathways Compatible with Long-term Goals. in Climate Change 2022: Mitigation of Climate Change. Contribution of Working Group III to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change 295–408 (Cambridge University Press, 2022). doi:10.1017/9781009157926.005

Please see our Reprint Guidelines for details on republishing our articles.