Shades of REDD+

Beyond carbon – evaluating the sustainable development co-benefits of carbon projects

The carbon credit ratings agency Calyx Global is pioneering a methodology to rate positive contributions to Sustainable Development Goals (SDGs) of carbon projects. As expert advisors to Calyx Global’s SDG assessments, we hope to raise the bar for these projects. Carbon projects could design and implement activities that will bring long-term positive changes for people and the planet, contributing to SDGs from local to global levels.

11 October 2022 | Thousands of carbon projects claim to positively contribute to SDGs beyond reducing or removing greenhouse gas (GHG) emissions. However, until very recently, there was no way to assess such claims and compare carbon projects according to their positive contribution to SDGs. In this context, Calyx Global’s SDG rating of carbon projects is marking a milestone toward a carbon market that values GHG mitigation and the broader co-benefits of carbon projects.

As of October 2022, Calyx has reviewed 117 projects with certified SDG contributions and can report the first findings. For example, projects that involve communities and focus on nature-based solutions show a higher likelihood of additional SDG impacts. Projects that are often more time-consuming to implement because they focus on improving livelihoods, in addition to climate challenges, are also more likely to generate additional SDG outcomes. The SDGs – other than SDG13 on Climate action- that are claimed most often by projects are SDG8 (Decent work and economic growth) and SDG15 (Life on land). While it is not surprising that projects that promote nature-based solutions claim SDG15 outcomes, the contribution of carbon markets to job creation is a little-known fact. Projects also use different methodologies to assess and report on SDG contributions, with cookstoves projects being more likely to follow a clear methodology to quantify outcomes (SDG 3 Good health and well-being) than other project types.

Why quantify SDG contributions of carbon projects?

The driver behind investments into carbon projects is the intent to generate GHG emission reductions and removals. The quality of carbon projects is first and foremost measured by how effectively they reduce or remove GHG emissions. High-quality carbon projects must also avoid harm to the planet and people. However, taking such a narrow view of carbon projects disregards the multi-dimensional positive impacts carbon projects can have on societal well-being and the planet. Limiting carbon projects to reducing emissions is like limiting agriculture to producing calories: Without considering agriculture’s many roles – such as ensuring prosperous livelihoods and landscapes, healthy soils and biodiversity, humanely-treated animals, and nutritious and balanced food – much of its essence, value and beauty is lost.

Sustainable carbon projects with long-term positive impacts take an integrated view across multiple outcomes. They maximize benefits ranging from reducing poverty and ensuring access to clean energy and water to enhancing biodiversity and coastal ecosystems. Projects that score high across multiple SDGs yield significantly more benefits than simple carbon projects. Such projects may often be more expensive in their design. Still, they are likely to enjoy broader support in local populations and thus be sustained much longer. In other words, they are more worthwhile projects that require additional investments.

Calyx Global’s rating of SDG contributions of carbon projects is also in line with proposals by entities such as the Integrity Council for Voluntary Carbon Market (IC-VCM) to tag carbon credits to highlight particular features of carbon credits. The IC-VCM consultation draft also requires carbon-crediting programs to incorporate guidance and provisions on using standardised tools and methods to assess the SDG impacts of mitigation actions and ensure a net positive SDG impact from carbon projects.

Who certifies SDG-related claims?

Calyx Global provides an SDG impact rating for projects that distinguish themselves by receiving an SDG certification through, for example, Verra’s Climate, Community and Biodiversity or Sustainable Development Verified Impact standards or the Gold Standard for Global Goals. These carbon-crediting programs offer a process for projects to measure and report SDG outcomes, including validating, monitoring, and verifying such outcomes. While most projects choose the route of attaching an SDG “label” to a carbon credit, both Verra and Gold Standard also offer, in theory, issuance of tradable SDG assets.

The credibility of SDG-related claims depends greatly on the credibility of the certifying standard and its governance – which constitute a logical first step for Calyx’s review of SDG claims. However, in the end, the SDG merits in scale and depth are project and investment-specific. Therefore, assessments of SDG impacts must look at each project individually and value SDG contributions at a granular level – while applying a standardized assessment methodology.

How to assess projects’ contribution to SDGs?

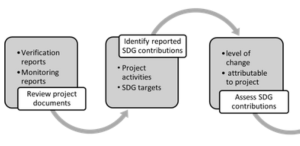

Calyx Global has developed a project-level SDG assessment that identifies SDGs to which a project claims to have contributed and assesses the degree to which these contributions can be attributed to the project as well as the depth and durability of those contributions. SDG contributions are tangible actions that projects claim, report on, and verify by third-party audits. Providing such a rating of projects according to their SDG contributions requires a standardized evaluation of claims that relate to nature, ecosystem, and well-being across an infinite diversity of project contexts.

This evaluation is not an easy task and has to overcome several challenges. A first barrier is the country-centric nature of UN SDG targets and indicators that were developed and are mostly measured at a global and national level. They are not always aligned with project-level interventions. It was, therefore, essential for Calyx Global to relate project activities to SDG targets. The chosen methodological approach allows mapping project interventions and activities to SDG targets to determine under which SDGs a given project’s contribution can be framed.

Calyx Global’s project assessment framework has been developed in reference to a methodology that Robert Müller and Thijs Merton have developed for the Fair Climate Fund. It rests on two pillars that ensure that projects make long-term contributions to SDGs:

- The benefit project claims can be attributed to the project activities. The level of assurance that a specific SDG contribution has occurred due to project activities depends on two factors. First, the contribution is predicted or actual. Second, it is described, estimated, or quantified using a clear methodology. The assessment framework checks if this is the case for each SDG contribution by a project.

- The benefits brought about by projects are deep and durable. For each SDG contribution identified, the assessment evaluates the level of change achieved by the project. In project results chains, project activities may lead to outputs, i.e. services or products delivered. These services or products can improve people’s lives and planetary health if they are taken up and used. Calyx evaluates whether the reported project contributions are at the level of output, outcome or impact hence gauging the long-term benefits of the project and its contribution to sustainable development.

The figure below summarizes the assessment methodology.

Approach to assessing and rating SDG contributions at the project-level

What remains to be done?

While Calyx is pioneering SDG ratings, more remains to be done to fully capture the SDG value of projects. For one, it is hard to assess the SDG impact of carbon projects until projects have reached a certain maturity. Another challenge is differentiating between SDG outcomes and impact at scale (i.e. impact per credit) and smaller-site specific SDG results. In many cases, the information provided by project developers also is scant, with gaps that make assessing outcomes difficult. Standards that certify SDG claims can do more to ensure their clarity and quality. For example, they can introduce more robust methodologies for baseline assessments, quantifying SDG impacts, and requirements and guidance for projects monitoring and reporting impacts.

Where are we hoping to take this?

A mature carbon market should be able to trade and value attributes beyond carbon. Indexed assets that standardize SDG contributions will allow buyers to formulate purchase orders with a minimum level of rated SDG contribution, which will help channel investments into projects that maximize carbon and SDG benefits. In this context, a robust SDG rating can help increase the overall confidence in carbon markets. Host countries will feel more confident about the local benefits of carbon projects. Buyers can reduce reputational risks. Most importantly, local community and ecosystems can fully enjoy their participation in global carbon markets.

The authors of this blog form part of Calyx Global’s independent oversight through its independent panels. The SDG Impact Panel brings together experts, including academics and practitioners, on climate change, carbon projects, and sustainable development to combine their knowledge and guide the SDG assessments of Calyx.

Please see our Reprint Guidelines for details on republishing our articles.