Who’s Buying Carbon Offsets?

Latest EM Insights Explores the Demand Side

Who’s buying offsets? According to the latest EM Insights on Voluntary Carbon Markets, it’s mostly European companies. Under the hood, there’s more nuance in terms of buyer preferences for specific standards, project types, non-carbon benefits, and vintages.

05 May 2021 | Carbon markets are booming. What will the demand for voluntary offsets look like if it is estimated that the market needs to grow 15-fold by 2030 and 100-fold by 2050 in order to meet Paris Agreement ambition? The third and final installment of Ecosystem Marketplace’s 2020 State of the Voluntary Carbon Markets report, published yesterday, explores some of the most significant trends and developments from the demand side.

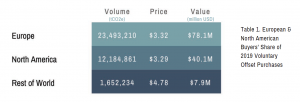

In 2020, the EM Global Carbon Survey received responses from its global network of EM Respondents, consisting of 152 project developers, investors, retailers, and brokers that provided carbon market transactions across 73 countries, 20 standards, 41 project types, and 21 buyers sectors. The report’s findings highlight some notable similarities and disparities between European and North American buyers, showing that in 2019:

- European buyers are gaining market share as they are purchased more offsets than other regions, increasing 48% in 2016 to 63% in 2019.

- Compared to Europe, a greater but declining portion of public sector and non-profit buyers are present in North America.

- In both regions, the Finance/Insurance sector bought relatively high volumes of carbon credits.

- Likely for reasons of supply, Europe was more likely to purchase international credits while North America tended to go domestic.

- While buyer preferences vary region to region for specific standards and project types, projects with carbon and non-carbon benefits consistently attracted premium prices.

Download the report for free now to read more on the EM Global Carbon Hub.

Please see our Reprint Guidelines for details on republishing our articles.