A New California Case Study Finds Eco-Assets Boost Property Sale Price

Assessing property for the endangered species it saves or wetlands it preserves could pay off for some landowners, says a California-based firm researching ecosystem markets. According to the firm’s latest case study, sale price tripled for a property in San Benito County, California once it considered eco-asset market values.

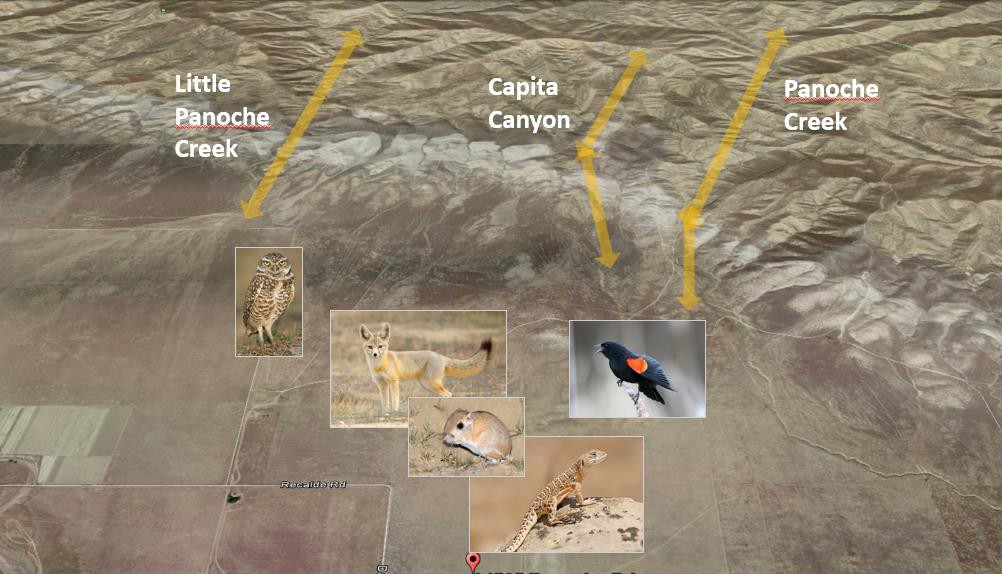

12 October 2016 | California’s Panoche Valley in San Benito County is a well-known biodiversity hotspot in the state. The roughly 30 square mile grassy lowland hosts a variety of threatened and endangered species including golden eagle, prairie falcon, western burrowing owl, San Joaquin kit fox, giant kangaroo rat, Nelson’s antelope squirrel and blunt-nosed leopard lizard.

However, the area is not immune to development interests and a California-based renewable energy company, PV2 Energy, has plans to construct a solar farm on 4,500 acres in the valley. The solar power facility will help the state meet its renewable energy goals, defined in the 2006 Global Warming Solutions Act, but it will also have an impact on local wildlife habitat. Alongside construction of the solar farm, PV2 Energy will need road upgrades, electrical facilities, water delivery systems, and it’s likely the farm will cause a flurry of nearby commercial business activity.

Because of the potential adverse impacts to biodiversity, state and federal agencies will require the various development interests to ensure “no net loss” of biodiversity through extensive compensatory mitigation measures such as conservation banking.

Landowners should be alert to new opportunities for increased property values or new revenues as a result of the regulatory requirements for protecting local biodiversity. For instance, a new case study from Eco-Asset Solutions & Innovations (EASI), a California-based firm focused on natural capital market values, determined that assessing a Panoche Valley ranch for “ecological assets” increased property value more than threefold.

Eco-Asset Valuation Explained

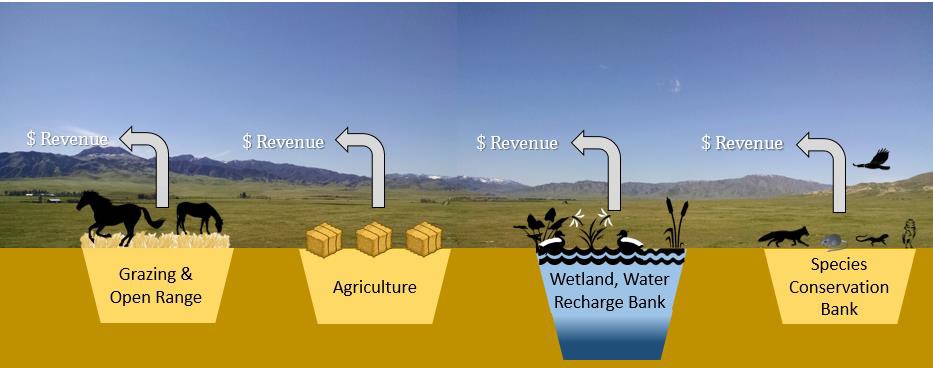

Rural landowners are often unaware that the ecosystem services – storing carbon, conserving biodiversity – their properties generate can be developed and taken to market like more conventional natural resources such as precious metals, oil or natural gas. Ecological assets come into being when a property’s ecological features, including rare habitats such as vernal pools, grasslands or certain scrub and forest lands, are converted into conservation or mitigation banking credits that can be sold in the environmental marketplace. These credits are awarded to landowners by state and federal agencies when properties are protected, enhanced or restored to support rare habitats and species. Landowners can then sell these earned credits to a wide range of buyers who purchase the credits to comply with environmental regulations.

New mapping data from Ecosystem Marketplace finds that markets for biodiversity along with other ecosystem markets that deal in carbon pollution and water quality experienced substantial growth over the past 10 years. Researchers credit this growth largely to enabling policy but also to the public’s growing awareness about the conservation and business value of these markets.

Many landowners still remain uninformed about the ecological asset value of their properties because 1) the distribution of property mitigation banks has seemed relatively sparse, hence neither landowners or realtors has given them serious consideration, 2) information about eco-asset development methods has not been readily available to the real estate community, and 3) lack of comprehensive market data has made it difficult for appraisers to know what these assets were worth in terms of property comparable sales or income analysis.

The sector needs a well-defined, value-based business approach to facilitate consistent, informed approaches to eco-asset valuation. Landowners and realtors alike have wanted the eco-asset valuation methods to be clearly described, to see accurate market data for mitigation credits, and to understand the risk:reward (cost:benefit) ratio of potential eco-asset developments for an individual property.

Potential to Make Money by Saving Species

Eco-asset markets have a 20-30 year history, especially in California where the state’s Department of Fish and Wildlife first instituted conservation banking in the 1990s.

The EASI Property Eco-Asset Survey evaluates rural land in relation to locally valuable biodiversity resources. Here, ‘valuable biodiversity’ has both a market connotation and an ecological connotation. EASI’s method combines publically available, biodiversity data that has site-specific property reviews and is endorsed by federal and state wildlife agencies. This provides an understanding of species’ presence as well as a property’s suitability to support valuable biodiversity resources.

EASI used this data to assess a privately owned 390 acre parcel in the Panoche Valley for its conservation bank potential. With the likelihood that PV2 Energy and its partners will line up to buy the species credits the bank generates, the landowner could create a handsome new revenue stream – that is if the property is suitable for a bank.

EASI learned that the property is at the edge of three migratory corridors for species moving between California’s Central Valley and the Coast Ranges to the west. Five high-value species are on or adjacent to the project site – burrowing owl, kit fox, kangaroo rat, leopard lizard and tri-colored blackbird. The property also has potential to generate wetlands and vernal pool mitigation credits.

EASI also drew on its Mitigation Credit Price Report (MCPR) and its Mitigation Credit Availability Report (MCAR) to support the business case for a property conservation bank in Panoche Valley.

The MCPR includes roughly 250 mitigation credit price references for California, from the early 2000s to the present day. Each record includes a permanent citation as to transaction location and date, buyer and seller, as well as price per mitigation credit. The parallel MCAR gives information about the distribution, type and number of mitigation credits currently approved for sale by agencies in the nearby area.

This information confirms the presence, scope and vitality of the compensatory mitigation market, something that appraisers need in order to estimate potential property income, sale value and respective worth.

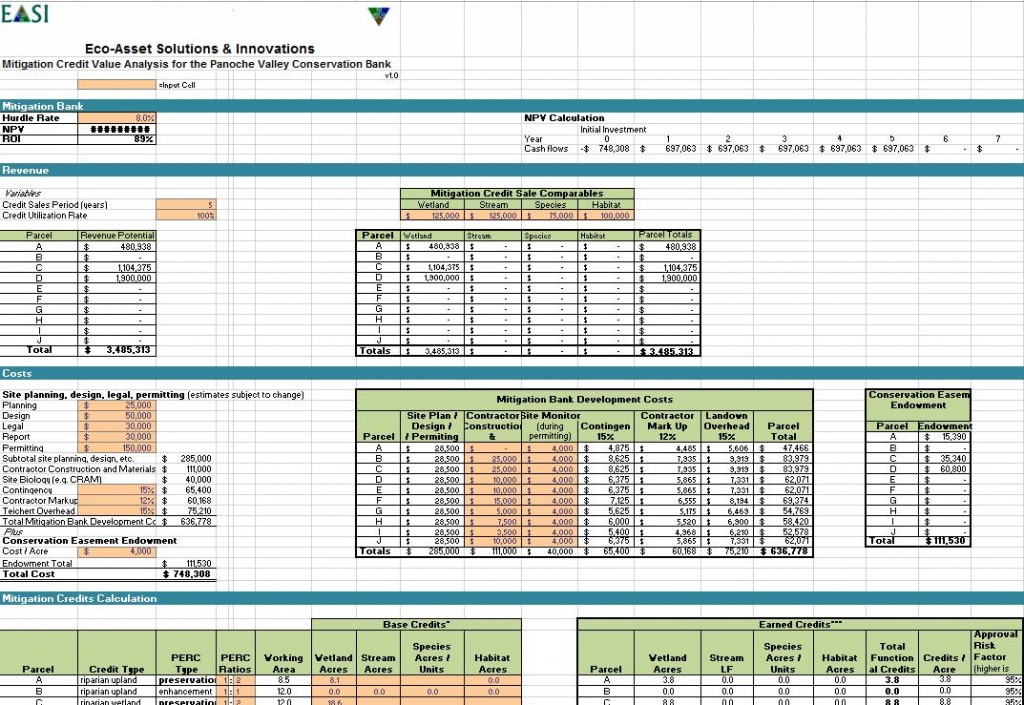

EASI then applied its mitigation banking financial model to pinpoint project development costs vs. potential revenues. The financial model leads to a project ROI and net present value calculation developed from scenario-planning variables.

Nature Boosts Property Value

EASI analysts estimated costs to develop a conservation bank at the Panoche Valley property at USD 475,000 including site biology, report writing, agency review fees and a conservation easement endowment. Total costs were $1.3 million including paying off the property mortgage.

Sale of 330 conservation credits (aka ‘species credits’) from the 390 acre property could generate $2.8 million in revenue based on MCPR market comparables. Additional wetland mitigation credit values were not included in this valuation. Even so, the valuation projected return on investment over five years to be 2.2:1, reinforcing the market value for property ecological assets (conservation credits).

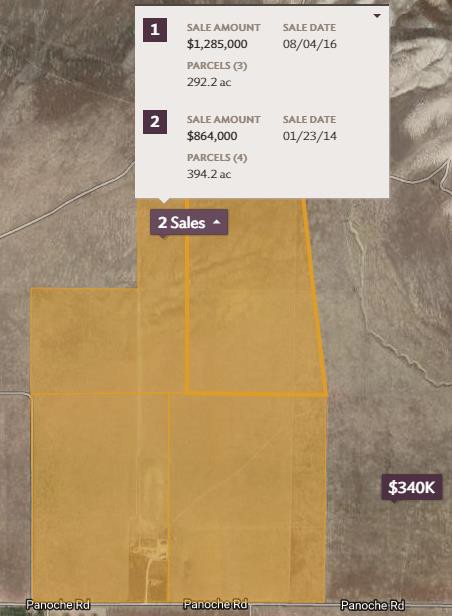

Instead of developing a mitigation bank, the property owner offered the undeveloped portion (290 acres) for sale at a price that reflected the property’s identified ecological asset values – that is, the estimated market value for future mitigation credits.

The landowner sold the undeveloped parcel to PV2 Energy as part of its compensatory mitigation plan in August, 2016 for $1.28 million, roughly $4,400 per acre. The seller had purchased the property two years earlier for $864,000, and that included a modern two-bedroom house, barns, and livestock infrastructure valued at about $365,000. Resulting land value was thus about $1,275 per acre. This compares well with the value of the adjacent property to the east (294 acres), which doesn’t contain any buildings or structures. In 2015, that parcel sold for $340,000, about $1,155 per acre.

Aiming for Holistic Valuations

Assessing the property’s eco-asset market value caused the undeveloped portion of the Panoche Valley property value to jump more than threefold – from $1275/acre to $4400/acre. And that’s without including the property’s potential to generate wetland and vernal pool mitigation credits alongside the conservation credits.

In the final analysis, this case study illustrates the significance of including eco-asset market data in a property appraisal. While it makes a big difference in terms of overall property worth, this approach also ensures holistic accounting for both market-based and sustainable ecosystem service values.

William Coleman has 40 years’ experience in environmental and sustainability management, specializing in ecological asset development and market management for agri-business and energy companies. He is currently managing his consulting firm, Eco-Asset Solutions & Innovations in the San Francisco area. He can be reached at woleman@easillc.com.

Please see our Reprint Guidelines for details on republishing our articles.