Trump Inheriting Healthy System of Environmental Markets, New Data Shows

US President-Elect Donald Trump is inheriting a healthy system of ecosystem markets, thanks in part to measures implemented by the Obama administration, but the exact growth has been difficult to quantify and understand. A new “Atlas of Ecosystem Markets” aims to change that by distilling data from several sources into a clear, simple, mapping tool for regulators, researchers, and users.

8 December 2016 | Environmental markets designed to funnel private-sector investment into conservation have grown dramatically under US President Barack Obama, according to new data compiled by Ecosystem Marketplace and available in a new mapping tool posted this week.

The news came, however, as President-Elect Donald Trump said he would nominate climate-science doubter Scott Pruitt to be the next administrator of the Environmental Protection Agency, casting doubt on the future of many initiatives.

Environmental markets aim to support conservation by putting a price on the ecosystem services nature provides, such as clean water and stored carbon. The new atlas was developed in collaboration with the US Department of Agriculture’s Office of Environmental Markets (OEM) and the Environmental Protection Agency (EPA). It charts the progression of ecosystem markets since the 1980s, and the accompanying report identifies market trends.

How we got here

Environmental markets began germinating in the 1970s, with the passage of such legislation as the Clean Water Act and the Endangered Species Act, but the Obama administration accelerated development last year, when it issued a Presidential Memorandum aiming to spur private investment in biodiversity protection by streamlining policy and transitioning to landscape level conservation.

The administration’s new vision for conservation requires land managing agencies adopt a holistic, landscape-wide approach to conservation. And since it released the memo, land managing agencies including the Department of Interior and the Fish and Wildlife Service (FWS) have issued new policies adhering to landscape level biodiversity conservation.

The FWS has actually released two. The first, in March, was a revision to an umbrella policy, which serves as overarching guidance on biodiversity protection measures.

The agency’s most recent policy move came last month. For the first time, the Service released a draft Compensatory Mitigation Policy specific to the at-risk species listed under the Endangered Species Act (ESA). In short, compensatory mitigation is government-approved methods, such as conservation banking or in-lieu fee mitigation, to deal with unavoidable impacts to nature, which includes endangered species.

The draft policy seeks a transition to landscape scale conservation and states a preference for advanced mitigation approaches listing a suite of tools. Eric Holst of the Environmental Defense Fund is pleased the organization’s brainchild, habitat credit exchanges, made the cut.

President of the National Mitigation Banking Association (NMBA), Don Ross, says the new policy incorporates many – but not all – of the NMBA’s essentials including mitigation in advance of impacts, durability of mitigation projects and the careful use of additionality.

Spurring Market Activity

At the end of last year, the DOI launched a Natural Resource Investment Center to enhance private investment in wetland and species mitigation. And just this past August, the EPA and USDA released a report pledging support to water quality trading markets in various ways.

The White House’s efforts to spur private investment in conservation show signs of success. Last March, 11 organizations – some public, though mostly private – committed over $2 billion to water, wildlife and land investments. It’s a commitment that the White House quickly labeled one of the biggest non-federal investments in conservation ever.

“Policy consistency and clarity across the board really ratchets up the opportunity for large-scale private investment in conservation,” George Kelly, Chief Markets Officer of Resource Environmental Solutions (RES), a Texas-based restoration company and one of the 11 entities pledging millions towards conservation activities, said in March.

When market practitioners such as Kelly couple the Obama administration’s interest in ratcheting up private sector investment in conservation with its preference for such advanced types of mitigation as conservation banking, they see the right atmosphere for market growth.

Biodiversity-related market activity is one of a few areas the government is laying down the groundwork for more environmental market activity. Last month, for instance, the Council on Environmental Quality released final guidance that instructs all federal departments to fully consider global warming and its impacts when making decisions and implementing activities. While not a slam dunk for market growth, some see it as another step toward the government eventually deciding to use offsets to manage its climate impacts.

There is also the Clean Power Plan, which the Environmental Protection Agency (EPA) officially unveiled last year. The plan remains tied up in court with an uncertain future, but if states do implement it, experts agree it opens the door for carbon trading on a grand scale.

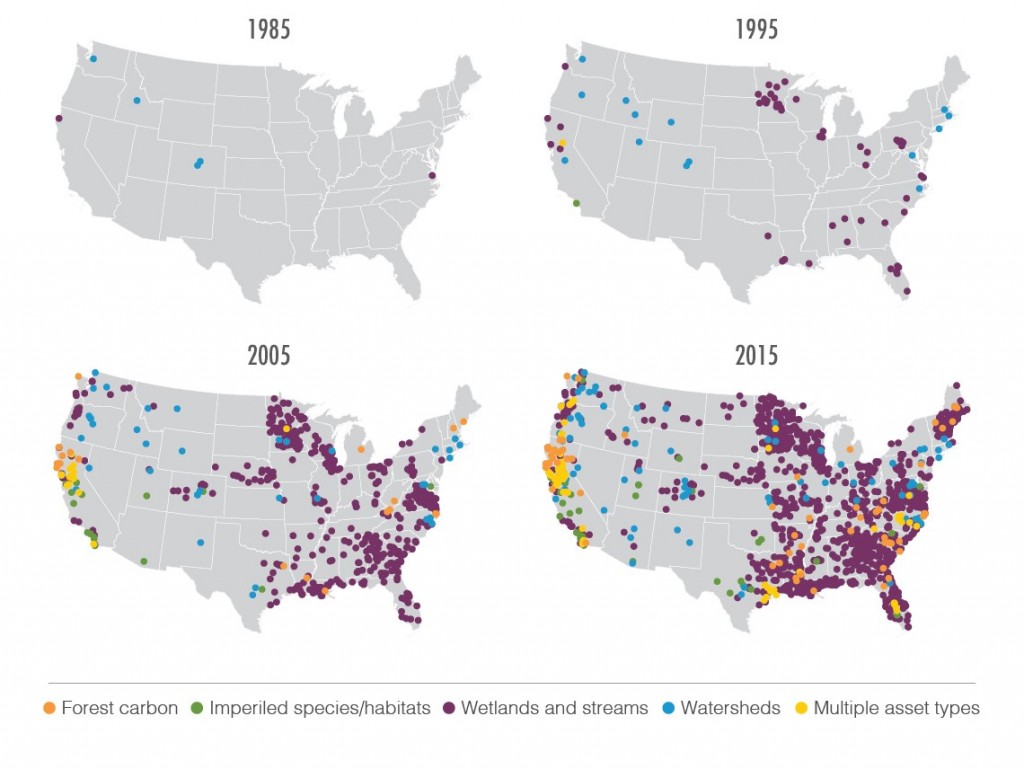

Growth in Ecosystem Markets Initiatives in the United States, 1985-2015

Mapping the Evidence

While this laundry list of policy activity tells the Obama administration’s story of enabling environmental market growth in the United States, the new mapping data offers a more visual depiction. Essentially, Ecosystem Marketplace, OEM and EPA created map layers based on Ecosystem Marketplace’s historical tracking data on water, carbon and biodiversity markets for EPA’s EnivroAtlas tool, a free online ecosystem services mapping platform offering more than 300 scientific and demographic layers.

An October 12th webinar presented the EnviroAtlas tool, awash with new data, as well as a new Atlas of Ecosystem Markets that will showcase market trends based on the mapping data. The Atlas, designed for a general audience, for the first time maps size, scale, and broad trends across ecosystem markets in the United States. Its creators also say the maps can serve as a decision-making tool for policymakers and other actors.

“Maps are an extremely good tool for communicating key concepts in ecosystem markets status and development,” says Genevieve Bennett, a Senior Associate at Ecosystem Marketplace leading the mapping project. “And readers interested in learning more or doing in-depth spatial analysis can visit EnviroAtlas or download our ecosystem markets map data free of charge.”

The maps offer a new way of looking at ecosystem markets and their broader political/demographic/landscape context, Bennett explains. The Atlas explores the connection between supportive policy, like state guidance on water quality trading, for instance, and where markets are active.

One key message runs throughout the study: ecosystem markets in the US have experienced substantial market growth in the last 10 years.

The data reveals a positive outlook for markets – at least for now. Policy winds can rapidly shift – Presidential Memorandums are a lot easier to undo than legislation – and a new political administration in the White House could change course or at least usher in a new layer of uncertainty for market participants.

Please see our Reprint Guidelines for details on republishing our articles.